Retirement planning in your 20's: planning to retire while you still have time on your side

Make extra money online writing for hubpages

Interested in learning how to make money online with hubpages.

Click here to get started.

It's free, it's easy, it's residual income!

Starting to plan for Retirement in your 20's

Planning for retirement in your 20's

Most people don't start worrying about retirement until much later (usually too late) in life. When you consider that the average person in their 20's is most likely going to be as poor at this point in their life as they will ever be, it makes it easy to justify them putting off retirement saving. In fact 20-somethings are twice as likely as any other group to have a negative net worth. This is due to various factors, such as college loans, lower paying jobs, and inexperience budgeting and handling debt. Most people in between the ages of 20 and 29 are more worried about there next check than what there investment accounts are going to look like 30 or 40 years down the road.

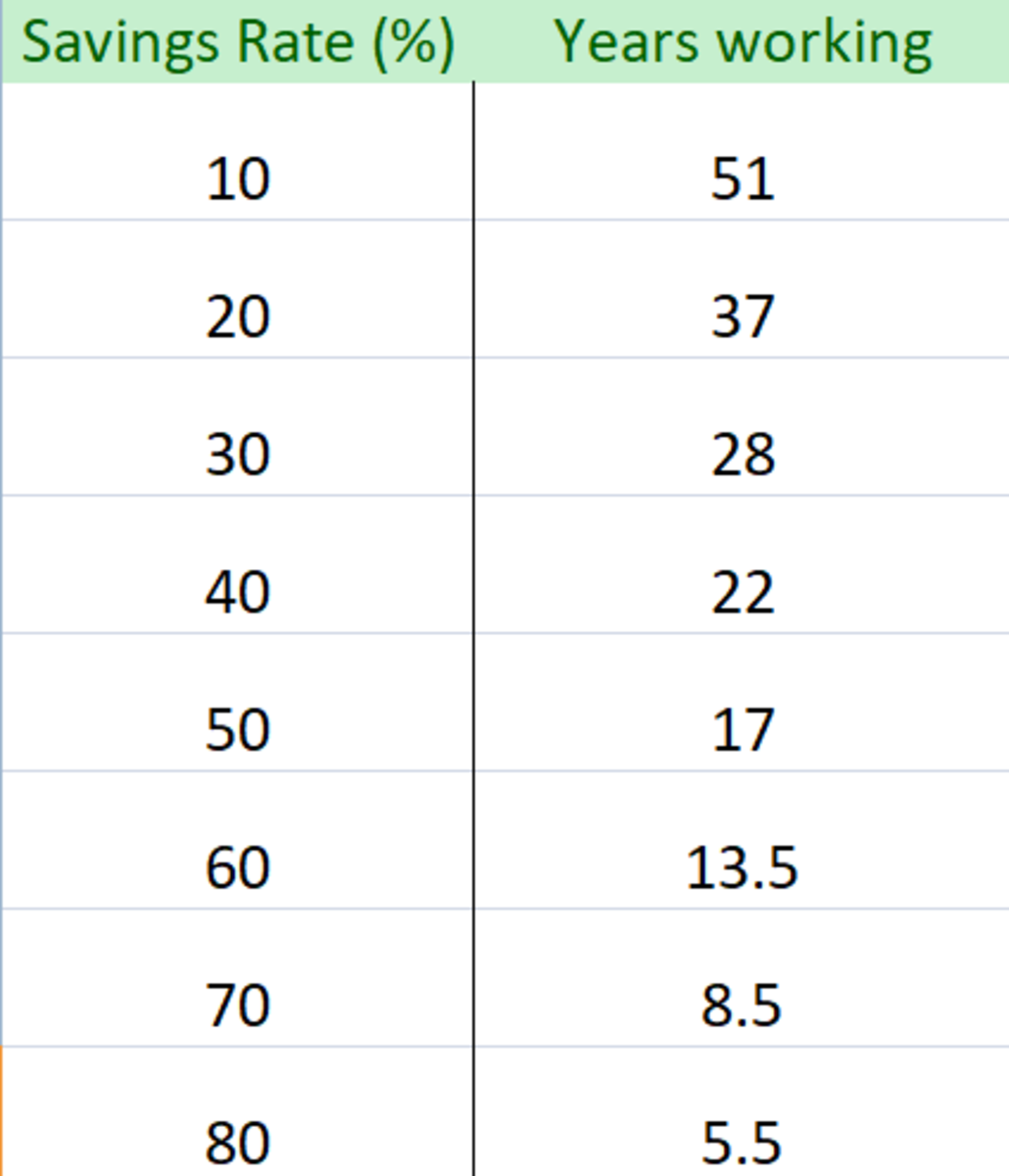

This is all very unfortunate because the beautiful thing about starting a retirement savings plan early is the power of compound interest. The power of compound interest is amazing, simply amazing... Albert Einstein once said that "The most powerful force in the Universe is compound interest", as well as referring to it as the "8th wonder (of the world)". Compound interest is simply Interest that accrues on the initial principal and the accumulated interest of the principle investment. The general idea is that this amount will grow exponentially rather than at a set rate (which is called simple interest). The most important thing to realize is how important that compounding factor is to the future value of your money.

In the next 2 sections below I will go into great detail about compound interest... if you already get the basic concept you can move ahead to the section about choosing your investment vehicles, but if you are a bit of a nerd and dig compound interest as much as I do you can read over the examples below.

Compound Interest

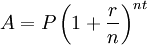

Compound Interest Formula

P = principal amount (the initial amount you borrow or deposit)

r = annual rate of interest (as a decimal)

t = number of years the amount is deposited or borrowed for.

A = amount of money accumulated after n years, including interest.

n = number of times the interest is compounded per year

How does compound interest affect retirement planning in your 20's

Some quick examples of compound interest...

Example 1: Let's say you have $1,000 in the bank and you are looking to invest and happen to find a bank that pays an interest rate of 10% (wouldn't that be nice!) and you decide that you are going to keep it in the bank for 10 years before you withdraw your funds.

Principle (P) = $1000

Interest Rate (R) = 10%

Time (T) = 10

By compounding (annually) $1000 at 10% for 10 years you would have $2,593.74 at the end of the 10 years.

Now this is probably oversimplified, and some of you may be thinking "so what? I waited 10 years for just over $2500. Well, if you take that same $1000 and a 10% interest rate and only change the TIme (T), to a higher number of years, you will see the difference...

Example 2:

Principle (P) = $1000

Interest Rate (R) = 10%

Time (T) = 40

By compounding (annually) $1000 at 10% for 40 years you would have $45,259.26... and if for some reason you decided to wait just one more year after that you would have $49,785.18. That is nearly $4,500 extra just because of one extra year.

Adding additional principle to compound your compounding interest

For those of you who were still not impressed with the compound interest you saw in Example 2 (where a one time investment of $1000 grew to over $45,000 over the course of 40 years), I think we will have to take it one step further by showing how continual additions can affect your money years down the road.Just to keep it consistent, what do you think would happen if you after the intial principle amount of $1000, you were able to continue adding $1000 per year...

Principle (P) = $1000

Interest Rate (R) = 10%

Time (T) = 40

Annual Addition (A) = $1000

By compounding (annually) $1000 at 10% for 40 years, and and additional $1000 added every year you would have $532,111.07. That is not a typo... You would have earned over a half million dollars off of an investment of only $40,000!

This is exactly the reason that Einstein was so impressed by the concept of compounding interest.

Investment vehicles for your retirement plan

How to get your retirement plan started

Now that we have gone over compound interest and the importance of starting to save early in life, we need to move on to the specifics on where to your money. While there are numerous different ways to save for retirement, I have outlined what I believe to be the most important investment vehicles. I believe the following investment vehicles offer the best opportunities to grow your money with the lowest tax implications.

1) 401K: Most people are familiar with the 401K, but don't know exactly why the 401K is so great.

2) ROTH IRA: The Roth IRA has become more popular over the last several years, but there are still many people missing out.

3. Simple IRA: This retirement solution requires that you either own, or are willing to start your own company, and is a great way to save for retirement in the absence of a 401K.

Planning for your retirement with a 401K

401K:

If you are fortunate enough to have an employer that is willing to match any of your 401K plan (or 403B for government and non-profit employees), you need to invest up to that matching point. let's say your employer matches 100% of your retirement savings contributions up to 6% of your salary. With a salary of $50,000, that would mean that your employer would match to $3000 dollars. This is basically free money, so at the bare minimum you wan't to make sure you are contributing $3000 for the year. In addition to the employer match you are also able to contribute this money before taxes, so you are saving whatever percentage tax bracket you are in on that contributions (if you are in the 25% tax bracket you are saving an automatic $750). When you do retire and start to draw that money from your account you will be taxed on that income but until that time this money will grow tax free.

My personal strategy has always been to contribute up to the employer match and contribute additional money to my ROTH IRA.

Planning for your retirement with a Roth IRA

Roth IRA:

I mentioned above that my personal strategy for retirement planning has always been to contribute up to the full employer match on my 401K and then use a Roth IRA for any additional retirement contributions. Some people think that you should just contribute more to your 401K since you are making these contributions tax free, but I believe that the Roth IRA is the better alternative, especially for younger folks in their 20's. While the Roth IRA is paid for with after-tax money, the money also grows tax-free (just like the 401K), but when it finally comes time to retire you will NOT be taxed on this money. This is incredible. I repeat, this is incredible, and everyone should be taking advantage of this,especially younger people. The main reason this is incredible is because we have no way of knowing what taxes will be like 20, 30, or 40 years down the road. Based on the growing National Debt, I think it is only logical to assume that in the future taxes will be much higher (or at the very least, the same as what they are now... but realistically you have to assume that taxes are going to grow higher and higher over time). If you are in your 20's you should be maxing out your Roth IRA contributions (as of 2012 the maximum you can contribute is $5000 if you are under the age of 50).

Another nice thing about planning your retirement with a Roth IRA is that you can use $10,000 for your first home if needed, and you are always able to withdraw your original contributions if the need should ever arise (just not the interest made on the money). This flexibility is a really nice bonus to saving for your retirement in a Roth IRA.

Retirement planning with a Simple IRA

Simple IRA:

A simple IRA is an alternative retirement investment vehicle to the 401K. If you own your own business, it is always a good move to put some of your profits into a simple IRA for the tax savings as well to make sure you are able to leave behind your business and retire when the time comes. Business owners would also be wise to save in a Roth IRA, but the Simple IRA is still a useful retirement vehicle and a good way to shield some of your business income from taxes.

Other hubs I have written

My other writing interests:

- How to make hot and sour soup

Learn how to make hot and sour soup. This ancient chinese soup serves 4-5 people. Great on a cold afternoon! - Make Money Like It's Your Job: A Beginner's Guide To Passive Income Make money using passive income techniques. Residual income every day!

- Specialty coffee industry analysis (is starbucks still the king?)

Specialty Coffee Industry Analysis. Starbucks verse Dunkin Donuts and McDOnals. Is the Coffee Industry slowly changing? - Starbucks Strategic Analysis (New strategies to stay ahead of coffee competitors)

Starbucks Strategic Analysis and Economic Analysis - Financial analysis of two companies

Financial Analysis of two companies. We put Darden Restuarants up against Brinker International. See who had the better ratios, margins, etc... - frugal living and having fun: live like a king on a jester's salary

Live like a king on a lower income. Follow these easy steps to save money. Frugal living is the way to go! - cost structure of a new cleaning company (what should your cleaning business be doing?)

- The best Chinese food ever: Kung Pao Chicken... spicy recipe (KUNG POW!)

My favorite Chinese Recipe. Kung Pao Chicken (spicy)! - Lawnmowers 101: The Best and the cheapest lawnmowers

Buying a lawnmower? There is a lot to think about... the first step iw whether you need a riding mower or a push mower. - Apple TV: How to install, connect, and configure your apple tv (simple programming system to reconfi

Install your new Apple TV! Configure Apple TV in one day! - how to start a new business: 5 basic steps to owning your own company

Start a new business from the ground up. 5 basic steps to owning your own company!

Other Compound Interest Links

- Stock Investment – Money Investment – Drip – a...

The power of compound interest is very powerful that every investment institution is using it in one way or the other. That is the reason these institution are able to hold investments running into billions of... - Compound Interest Calculation & The Rule of 72

This formula is from http://en.wikipedia.org/wiki/Compound_interest#Mathematics_of_interest_rates Simple interest is interest calculated only on the original principal of the loan or asset. Compound...